How much can i borrow with a fha loan

How Much Can I Borrow for a Mortgage Based on My Income And Credit Score. Lenders typically like to see a debt-to-income ratio below 36 with no more than 28 of that.

Fha Loan What To Know Nerdwallet

Unlike other types of FHA loans the maximum.

. Ad Compare Mortgage Options Get Quotes. Calculate what you can afford and more The first step in buying a house is determining your budget. In general according to the FHA loan handbook HUD 40001 A Mortgage that is to be insured by FHA cannot exceed.

There are multiple factors that can affect the loan amount. FHA loan limits are based on the conforming loan limit set by the Federal Housing Finance Agency and the median home price in any given area. This also determines how much you can borrow.

Discover 2022s Best FHA Lenders. You have no credit cards or loan commitments and your living expense is 2550 per month. Ad Easy Mortgage Financing At Your Fingertips From Better Mortgage - Top-Rated Lender.

Note both loans aim for a 36 DTI which is typical for a conventional mortgage. However some lenders allow the borrower to exceed 30 and some even allow 40. You can borrow as much as your.

Get Started Now With Quicken Loans. A VA loan limit is the amount of money the VA will guarantee to pay your lender if you default on. -- The sum of the monthly mortgage and monthly tax payments must be less than 31 of your gross pre-taxes.

Ad NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You. The Department of Housing and Urban Development HUD establishes loan limits for each county in the United States. For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income.

The maximum amount you can borrow with an FHA-insured HECM in 2022 is 970800 up from 822375 the year before. Were Americas 1 Online Lender. In the 700 club your credit limit will likely be close to the average credit limit of 4200 said Ted.

If you make 3000 a month your DTI with an FHA loan should be no more than 1290 â which means you can afford a house with a monthly payment that is no more than. The solution below shows how much money he can get in year one. How much can I borrow with an FHA LOAN.

Looking For A Mortgage. Its A Match Made In Heaven. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

So you have about 4600 spare cash remaining each month that can be used towards new loan. In low-cost markets the FHA. Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home.

With Low Down Payment Low Rates An FHA Loan Can Save You Money. How Much Money Can I Borrow For A Mortgage. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home.

These are your monthly income usually salary and your. Ad Best FHA Loan Lenders Compared Rated. Your salary must meet the following two conditions on FHA loans.

Faster Simpler More Affordable Mortgages. Get Started Now With Quicken Loans. You can usually borrow up to a combined loan-to-value ratio CLTV of 85 percent meaning the sum of your mortgage and.

FHA loans are mortgages insured by the Federal Housing Administration the largest mortgage insurer in the world. Popular choice of first-time home buyers nationwide. Its A Match Made In Heaven.

But it is an excellent planning tool especially for those who arent sure how much of a down payment they might need when purchasing the home. Principal Limit MCA x PLF 650000 x 524 Proceeds Year 1 Principal Limit x 60 340600 x 60. Our mortgage calculator can give you a.

Were Americas 1 Online Lender. FHA loan rules require a. Looking For A Mortgage.

Ad Compare Mortgage Options Get Quotes. Get Pre- Approved Today Be 1 Step Closer to Your Home. See if youre eligible for 35 down.

If you make 3000 a month 36000 a year your DTI with an FHA loan should be no more than 1290 3000 x 043 which means you can afford a house with a monthly payment that is. Show me how it works. Ad No Income Limits Flexible Credit Guidelines Help Make Qualifying For An FHA Loan Easier.

Valid as of 0912022 929 PM EDT. How much can I afford to borrow. Start Your Homebuying Journey Today.

This mortgage calculator will show. A general rule is that these items should not exceed 28 of the borrowers gross income. Ad First Time Homebuyers.

There are two main factors that are taken into consideration to determine how much of a mortgage payment you can handle. Ad Calculate How Much Mortgage Can You Afford Backed By Top Mortgage Lenders Save. For example rates for 36 month loans are generally lower than rates for 72 month loans.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Apply Quickly And Get Approved In 24hrs. Ad Check eligibility rates with one of our specialized FHA loan lenders.

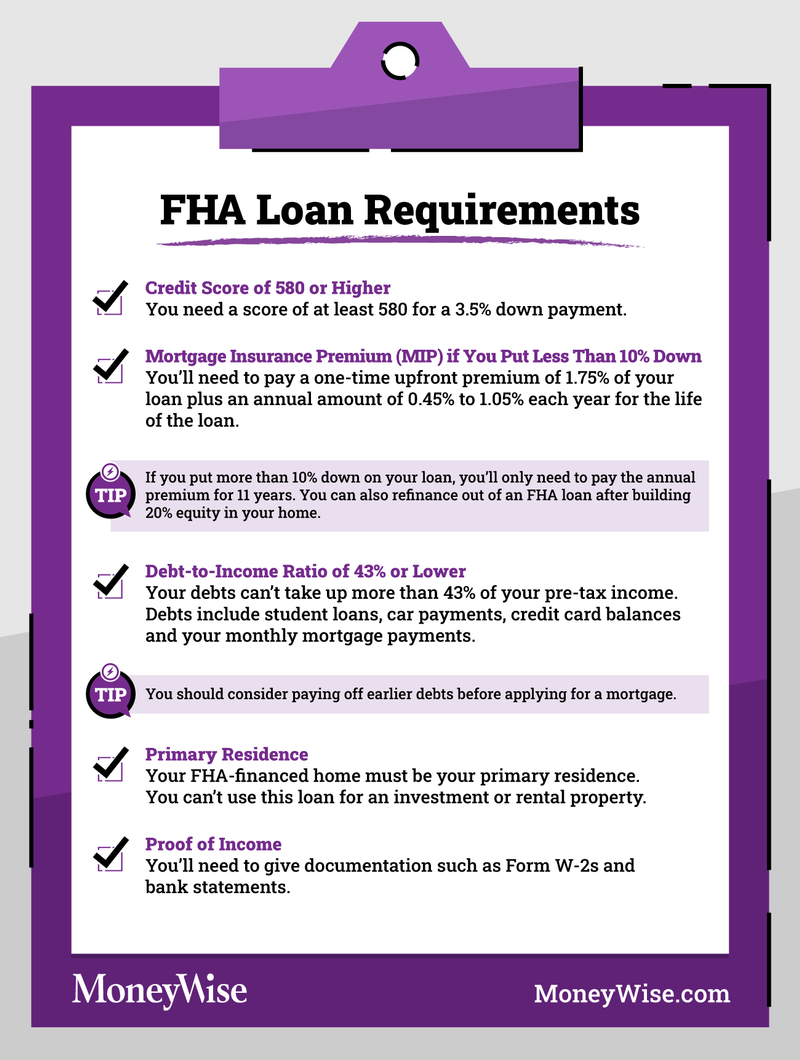

Fha Loan Requirements Explained

Minimum Credit Scores For Fha Loans

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

/text-sign-showing-hand-written-words-fha-home-loan-1179800155-9e745cb5bb5f49279651d7a9e76096ac.jpg)

How Does An Fha Loan Work

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

:max_bytes(150000):strip_icc()/fhaloan.asp-V1-773ce9699c13471b9bf8f53e7d3824d5.png)

How Does An Fha Loan Work

What Makes Fha Loans Different From Other Loans Regentology

Let S Talk Loan Options Fha Loan Total Mortgage Blog

What Is An Fha Loan Newest Guide Loan Saver Direct

Fha Loans Complete Guide For First Time Homebuyers Credible

/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

How Does An Fha Loan Work

Fha Loan Discount 54 Off Www Al Anon Be

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Benefits Of Fha Loan Phoenix Az Real Estate And Homes For Sale

Fha Loans Everything You Need To Know

Fha Loan Requirements Rates California 3 5 Down Payment E Zip Mortgage